Top Trends in Cash Flow Management

Introduction

Cash flow management is a growing field that’s changing the way companies do business. It’s not just about managing the money coming in, but also the money going out. Companies are looking at ways to reduce their cost of capital and improve their performance metrics by using technology to increase efficiency in this area. In this article we’ll take a look at some of these trends as well as discuss how they impact businesses today:

Increased Government attention on tax oversight

There is an increased focus on tax fraud in the US. This can be seen through the IRS’ recent actions to combat tax fraud and the creation of a new unit dedicated to investigating and prosecuting cases of business income reporting violations. The IRS has also worked with state and local governments to help them enforce their own anti-fraud laws, as well as analyze data collected by these agencies in order to better understand their own compliance efforts.

The IRS uses several tools for catching potential tax cheats:

- Data analytics—the IRS analyzes financial statements submitted by businesses looking for inconsistencies or irregularities that could indicate a potential violation (e.g., discrepancies between reported gross profit and figures obtained from other sources). In addition, they use algorithms that automatically search through large amounts of publicly available information such as court records or news articles related to specific individuals who may owe back taxes; these algorithms look for patterns among these users’ activity—for example, whether they tend not to pay their bills on time—and then compare those patterns against what should happen if someone were actually paying off debt instead.

Data analytics in the fight against fraud

Fraud is a big problem for businesses. It’s estimated that up to 80 percent of all fraud cases go unreported, so the best way to fight it is through data analytics.

One example of how fraud can be detected through data analytics is through credit card transactions. If you have an issue with fraudulent activity on your account, then there are several things you can do:

- Contact your bank to see if there’s anything suspicious about their records

- Look for suspicious patterns in customer spending habits (e.g., lots of international purchases)

Employing automation and AI in contracts.

As a business owner, you know that contracts are the lifeblood of your company. They’re what keep your employees and clients in line, but they can also be an enormous drain on resources. That’s why it’s important to automate as much of the contract management process as possible in order to save time and money while still maintaining high levels of quality control.

AI has become an integral part of this effort—it allows companies like ours to reduce costs and streamline processes so that we can focus more on what matters most: delivering excellent customer service!

Using data to improve budgeting and forecasting

Data analytics can help you forecast future cash flow.

As a business owner, it’s your goal to keep track of every dollar that comes into or goes out of your company. This means that you need a system for collecting and analyzing financial data so you can make informed decisions about how much money is coming in, where it’s going and what needs to be done with it. Think about how much time is spent on manual processes like budgeting, reporting and forecasting. With data analytics software like ours at eBudget Finance Manager Pro (EFM), we give businesses the information they need when they need it most—in real time!

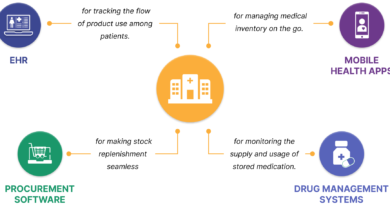

Working capital management and supply chain financing

Working capital management is the process of managing your company’s current assets, such as accounts receivable and inventory. This is done so that you can better manage your cash flow. Supply chain financing is a different type of financing that involves providing funds to suppliers or other business partners in exchange for payments over time rather than paying off an entire purchase immediately.

The benefits of supply chain financing include:

- Improving customer loyalty by offering incentives like discounts or free shipping on orders placed through the company website (or app).

- Increase sales by providing customers with access to additional products they might not have known about before using your site/app.

Supply chain financing also helps improve working capital management because it allows companies like yours:

A lot is going on with managing cash flow at the moment.

It’s a busy time for cash flow management. There are so many companies struggling to manage their cash flow, and many are using technology and professionals like accountant gosford to help them do it better.

How did we get here? Well, the economy is still recovering from its 2008 crash, which meant that many businesses were unable to pay their bills on time or at all. This led many companies into serious financial trouble and forced them to seek outside funding from investors or banks in order to stay afloat until things got better again. Some industries were hit particularly hard due to their reliance on customers who weren’t able—or willing—to pay their bills as quickly as they needed to: namely, construction firms who relied heavily on government contracts during times of economic recession (such as those experienced during this millennium).

Conclusion

There is a lot going on with managing cash flow at the moment. It’s important to keep up-to-date with new regulations and best practices, but also ensure you have a plan in place for when things go wrong.