Next‑Gen Investment Strategies: The Role of AI in Smart Portfolio Management

Investing has evolved dramatically in recent years. With markets becoming increasingly complex and diversified, modern investors are tasked with monitoring multiple assets, analyzing trends, and making informed decisions in real time. Traditional methods like spreadsheets and manual tracking are no longer sufficient for the demands of today’s financial environment.

This is where tools like AssetWisp, an advanced AI investment app, are transforming how investors manage their portfolios. By combining artificial intelligence with intelligent analytics, AssetWisp enables users to turn raw data into actionable strategies, streamline portfolio management, and make smarter investment choices.

The Complexity of Modern Investing

Today’s investors deal with a wide array of asset types—from stocks and ETFs to cryptocurrencies and alternative investments. Each of these markets moves at different speeds and responds to different economic signals. This complexity makes it challenging to maintain a clear understanding of portfolio performance without the right tools.

Investors also face the pressure of rapidly changing market conditions. Without timely insights, they risk making decisions based on incomplete information. AI-powered platforms are increasingly filling this gap by providing real-time analytics and actionable recommendations.

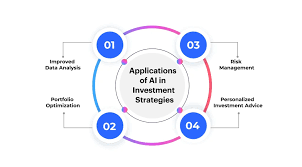

How AI Is Shaping Investment Decisions

Artificial intelligence has transformed investment strategies by processing vast amounts of data and detecting patterns that human analysts might overlook. Tools such as AssetWisp AI stock analysis provide investors with comprehensive insights into market behavior, helping them anticipate trends and make informed choices.

AI also enables more accurate investment insights, offering guidance on potential risks and opportunities. For example, algorithms can assess historical data, monitor volatility, and suggest when to enter or exit positions. This allows investors to approach portfolio management with greater confidence.

Centralized Portfolio Management

Consolidating Multiple Assets

Managing diverse holdings can be cumbersome without a unified system. AssetWisp portfolio tracker allows investors to consolidate stocks, crypto, and other assets in a single dashboard.

Specialized tools like a stock portfolio tracker or crypto portfolio tracker give users a clear view of individual asset performance while maintaining oversight of overall portfolio health. This centralization simplifies decision-making and ensures that investors stay informed about the relative contribution of each holding.

Optimizing Performance

Beyond tracking, the goal of portfolio management is to improve returns. AssetWisp supports portfolio optimization by analyzing asset allocation and suggesting adjustments that enhance performance. With features such as an investment performance tracker, users can monitor growth, evaluate strategy effectiveness, and implement data-driven changes to strengthen their portfolios.

Real-Time Alerts and Actionable Signals

Timing is critical in investing. AssetWisp offers a price alerts app that notifies investors of significant market movements. When paired with a market analysis app, these alerts help users make decisions promptly, reducing the likelihood of missed opportunities or unexpected losses.

The platform also delivers AI trading signals and buy sell hold signals, providing clear guidance for both long-term investment strategies and short-term trading. Investors can rely on these insights to act decisively in volatile markets.

Smarter Decisions Through AI-Driven Analytics

A major advantage of AI-powered tools is their ability to turn complex data into understandable insights. AssetWisp functions as a full investment analysis app, evaluating market trends and generating actionable recommendations.

With AI at the core, users gain deeper knowledge of market behavior, allowing them to identify high-potential investments, manage risk, and refine strategies across multiple asset types. This approach enhances decision-making, making investment more predictable and less reliant on guesswork.

Why Modern Investors Prefer AssetWisp

Next-generation investors are drawn to platforms that combine intelligence, efficiency, and accessibility. AssetWisp offers:

- Integrated portfolio management app features for multiple asset classes

- AI-driven analytics for enhanced investment insights

- Real-time alerts and signals to act on market changes

- Tools for portfolio optimization and performance monitoring

By centralizing data and leveraging AI, AssetWisp empowers investors to make informed, timely decisions and achieve more strategic portfolio management.

Conclusion

Investing in today’s complex markets requires more than intuition; it demands tools that transform data into decisions. AssetWisp demonstrates how AI can provide both intelligence and clarity, helping investors manage diverse portfolios efficiently. From consolidated tracking to actionable signals, AssetWisp equips modern investors with the capabilities needed to optimize performance and navigate dynamic financial markets with confidence.

For anyone looking to approach investing in a smarter, data-driven way, adopting AI-powered tools like AssetWisp is an essential step toward achieving portfolio success.