Decreasing Term Insurance – What Is It? Learn More About It

You may already have an idea about what is term plan and the core features and benefits of these policies. Yet, when you buy a term plan online, there are several kinds of options that you may have to choose from, depending on the insurer. One of these options is a decreasing-term insurance policy. This article looks deeper into these term plans and whether they are suitable for you.

What is decreasing term insurance?

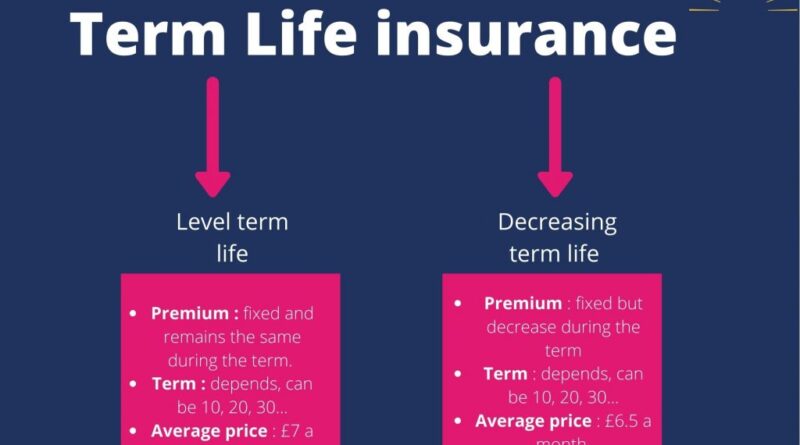

Concerning any decreasing term insurance plan, the coverage given within the policy will keep reducing annually at a pre-determined rate. However, the factor worth noting here is that the premium paid by the policyholder will stay the same throughout the entire duration of the policy. So, keeping this aspect in mind, why should someone invest in decreasing term insurance then?

Most features of decreasing term insurance policies are the same as regular term insurance plans. However, unlike their traditional counterparts, the sum assured amount keeps reducing every year throughout the policy tenure in the case of decreasing term plans. The customers can choose the policy period, and although the risks reduce for the insurer, the premium amount remains unchanged.

The rates for premiums are also lower in the case of these plans as compared to conventional term insurance policies. It is for stages where the sum assured amount is the same for both plan types. Upon the plan’s maturity, the sum assured becomes zero. Whenever there is the untimely demise of the insured person within the policy period, the sum assured amount is paid to the nominee. However, this is not a pre-agreed amount and is based on what is applicable for a specific year. Do these policies have any advantages? Here is a closer look at them for a better understanding.

Benefits of Choosing Decreasing Term Insurance Policies

Decreasing term insurance policies are helpful for those with liabilities, expenditures set to reduce in the future, and dependents about to turn independent from a financial perspective. Here are some of the benefits of selecting decreasing-term insurance policies:

- Lower Costs- Term insurance is one of the most affordable coverage options in the market. Decreasing term insurance policies have even lower premium amounts due to steadily reducing risks for the insurer. The premium stays the same throughout the policy duration.

- Higher Flexibility- You can enhance these plans with more layers of security and riders that provide specific benefits. Rider options like critical illness or accidental disability can help boost the scope and coverage of the plan.

- Convenient Coverage- The coverage amount depends on factors like the policyholder’s financial goals, annual income, and liabilities. This amount may change at different life stages and varying circumstances, mainly where income increases and liabilities come down. For example, those taking a particular amount when they were young may not require similar coverage later in life. A decreasing term policy ensures that you get suitable coverage based on your needs and life stage, taking it to an optimum level.

- Tax Savings- Decreasing term life insurance premiums are eligible for tax deductions up to Rs. 1.5 lakhs under Section 80C. The death benefit from the plan also has exemptions from taxes as per Section 10 (10D).

An example will help you understand the concept. Suppose you purchase a decreasing term insurance plan with a sum assured of Rs. 50 lakhs. The decreasing rate is 10% each year as an average figure. Hence, the sum assured will come down to Rs. 45 lakhs in the second year. If you pass away in the second year of the policy, the family will get Rs. 45 lakhs as the sum assured payout from the insurance company.

Choosing decreasing term insurance policies- When is the best time?

The reason for such a policy is that people have varying life insurance requirements with time. Coverage needs may come down with age when the liabilities come down, and income goes up. At the same time, the premium amount is considerably lower compared to other term insurance plans. It benefits those buying term insurance at a specific time to cover their financial liabilities like home loans, car loans, etc. The policy makes sure that the family will not have to cover these liabilities in case of the policyholder’s demise within the policy period. While people keep repaying their loans, the sum assured amount also comes down simultaneously in such a scenario. You may consider this option when you buy a term plan online. However, it should fit your needs and specific objectives. Otherwise, you are better off with regular term insurance coverage that ensures adequate financial security for your family in the event of your unfortunate demise