How Can I Know My CIBIL Score Quickly and Securely?

In today’s financial landscape, understanding your credit health is more important than ever. Whether you’re an individual seeking a loan or a business evaluating your financial standing, your CIBIL score is a crucial factor. Many people often ask, “How can I know my CIBIL score quickly and securely?” Fortunately, there are efficient ways to obtain this essential information. In this article, we will explore how you can access your CIBIL score, why it matters, and the significance of a commercial CIBIL score.

What is a CIBIL Score?

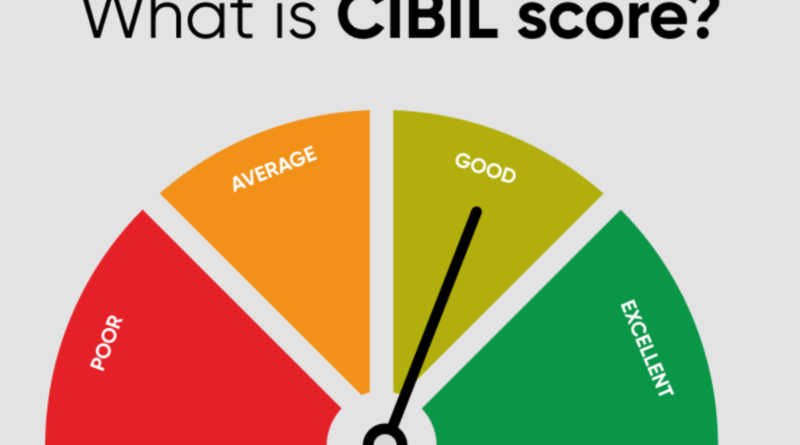

Before diving into how you can know your CIBIL score, it’s important to understand what a CIBIL score is. A CIBIL score is a three-digit number ranging from 300 to 900, representing an individual’s creditworthiness. This score is calculated based on your credit history, including your repayment track record, the amount of credit you have used, and other related factors. Lenders use this score to assess the risk involved in lending money to you.

A higher CIBIL score indicates reliable credit behavior, making it easier to secure loans or credit cards. Conversely, a lower score suggests potential risk to creditors, which might make accessing credit more difficult or costly.

How Can I Know My CIBIL Score Quickly?

When pondering the question, “How can I know my CIBIL score quickly?” there are several seamless options available. Here are some of the simplest ways to access your CIBIL score swiftly:

1. Online via CIBIL Website:

One of the most straightforward methods is to check your score directly through the official CIBIL website. You can create an account or log in if you already have one. Once logged in, you can follow the instructions provided to view your CIBIL score instantly. For a more comprehensive understanding of your credit health, you can also download your credit report.

2. Mobile Applications:

Numerous financial apps provide the option to check your CIBIL score. These apps often offer additional financial services as well, though they typically require you to register and provide identity verification information to ensure security.

3. Bank Websites:

Some banks offer their customers free access to their CIBIL scores via online banking portals. This service is typically available to existing customers, and it offers a convenient way to monitor your credit health without leaving the bank’s secure online environment.

4. Third-party Websites:

Several third-party financial services websites offer free credit score checks. While this option can be convenient, it is important to choose a reputable site to ensure your information remains secure.

Ensuring Security While Accessing Your CIBIL Score

Security is a paramount concern when accessing your credit information online. Here are some tips to ensure you obtain your CIBIL score securely:

– Use Official Channels: Always prefer checking your CIBIL score through official platforms or well-established financial apps and websites. Avoid clicking on suspicious links or ads that claim to offer free CIBIL score checks.

– Secure Connection: Make sure you are accessing your score over a secure internet connection. Avoid using public Wi-Fi networks, which can be susceptible to hacking.

– Strong Passwords: Use strong, unique passwords for your online accounts. Consider enabling two-factor authentication to add an extra layer of security.

– Be Wary of Scams: Be cautious of any emails or calls requesting personal information to check your CIBIL score. CIBIL and reputed financial organizations will never ask for sensitive information in this manner.

Why Is Knowing Your CIBIL Score Important?

Knowing your CIBIL score is crucial for several reasons. Firstly, it provides insight into your financial health and creditworthiness. This knowledge can be instrumental if you’re planning to apply for a loan, rent a home, or make significant financial decisions. Furthermore, since your CIBIL score affects the interest rates on loans, a good score can lead to substantial savings.

For businesses, understanding the commercial CIBIL score is equally vital. Just as individuals have credit scores, businesses do too. A commercial CIBIL score represents a company’s creditworthiness, based on its credit history and financial behavior. Lenders and suppliers often review this score when deciding to extend credit or enter a partnership with a business. Thus, a solid commercial CIBIL score can enhance a company’s credibility and financial opportunities.

Factors Affecting Your CIBIL Score

Understanding the factors that influence your CIBIL score can help you maintain or improve it over time. These factors include:

1. Payment History: Timely payment of credit installments and credit card bills positively affects your score.

2. Credit Utilization Ratio: High credit usage compared to your total credit limit can negatively impact your score. Aim to keep usage below 30% of your available credit limit.

3. Length of Credit History: A longer credit history can contribute positively to your score as it provides a clearer picture of your credit behavior over time.

4. Credit Mix: Having a variety of credit types, such as secured loans (home loans) and unsecured loans (credit cards), can favorably influence your score.

5. Hard Inquiries: Each time you apply for credit, it leads to a hard inquiry on your report. Frequent inquiries within a short period can reduce your score.

Tips to Maintain a Strong CIBIL Score

Improving and maintaining a strong CIBIL score takes disciplined financial habits. Here are practical tips to help you boost your score:

– Pay on Time: Always make timely payments, including EMIs and credit card dues. Missing payments can significantly lower your score.

– Monitor Your Credit Report: Regularly review your credit report to identify any discrepancies or fraudulent activities. You can dispute errors to ensure your report accurately reflects your credit history.

– Limit Credit Applications: Avoid excessive credit applications within a short period. Space out your credit inquiries to maintain your score.

– Reduce Debt: Work towards reducing outstanding debt as high debt levels can adversely affect your score.

– Maintain a Healthy Credit Mix: Try to have a balanced mix of secured and unsecured loans.

– Increase Credit Limit: If you tend to frequently reach your credit limit, consider requesting an increase. This can help lower your credit utilization ratio but ensure you still spend within limits.

Conclusion

In conclusion, knowing your CIBIL score quickly and securely is essential for both personal and commercial financial health. By understanding the factors that affect your score, you can make informed financial decisions. Whether you’re using the CIBIL website, banking portals, or trustworthy mobile apps, you have multiple options to access your credit information securely. Moreover, with the growing importance of credit scores in both personal and professional realms, staying informed about your CIBIL score and maintaining good financial practices cannot be overstated. Prioritize your credit health today, and enjoy the benefits of sound financial management.